Economists are predicting home prices nationwide will stabilize by the end of 2012. In contrast, certain pockets around the country, like some neighborhoods in Fort Lauderdale, home prices are already on the rise.

A recent Market Report issued by Clear Capital, a provider of data for real estate asset valuation and risk assessment, reflected that while year-over-year prices notched down in 2011, prices are expected to see slight uptick in 2012, the first time in positive territory since 2006.

“Overall, 2011 was a relatively quiet year for U.S. home prices compared to the last five years,” said Dr. Alex Villacorta, Director of Research and Analytics at Clear Capital. “With national prices down a little more than two percent for the year and sitting at their lowest point since 2001, our projections show that the current balance the market has found will continue through 2012.”

“However, individual markets reacting to their local economic drivers exhibit a wide range of performance levels,” added Dr. Villacorta. “Although the national numbers suggest markets are flat, when looking at individual metro markets it turns out only 24% of them showed signs of stabilization in 2011, while the others are still moving more dramatically higher or lower. ”

In other words, while changes in home prices nationwide were mild for 2011 and the 2012 U.S. market forecast is flat, when looking at markets separately, Clear Capital reported extremes – both positive and negative.

On the negative end of the spectrum, the Market Report noted four metros posted price declines greater than 10%, with Atlanta leading the way down with a -18.3% price change, followed by Seattle, WA at -15.1%. Birmingham, AL and Detroit, MI also rode the markets down with -11.1% and -10.8% price drops, respectively.

On the positive side, Dayton enjoyed 11.5% annual price growth in 2011. The next two strongest performers came from Florida, with Orlando and Miami* basking in 6.7% and 5.6% price gains, respectively.

*The Miami market includes both Miami and Fort Lauderdale.

“What’s most interesting is that the lower segments of appreciating markets are driving much of the current price growth. In places like Florida, which have historically been hard hit, we are now seeing considerable activity in lower-end properties as demand continues to heat up.”

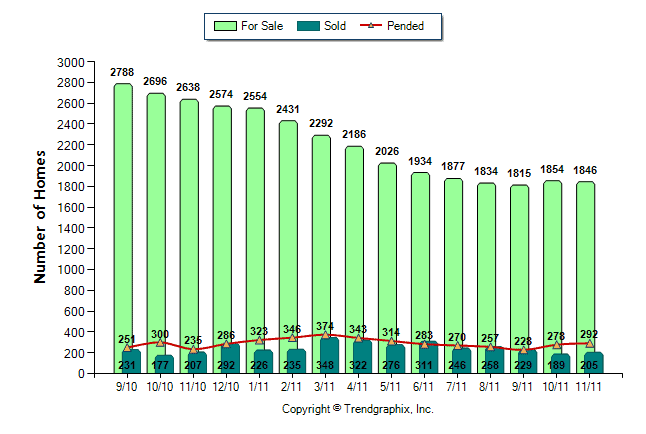

At Luxury Living Fort Lauderdale, we’re seeing home prices increase in east Fort Lauderdale neighborhoods like Coral Ridge, Downtown Fort Lauderdale, Las Olas Isles, Rio Vista and Victoria Park. In these areas, inventory levels have decreased (see graph), which seems to be directly affecting an increase in multiple offers for the same property and home prices.

|

Curnt vs. Prev Month |

Curnt vs. Same Month 1 Yr Ago |

Curnt vs. Same Qtr 1 Yr Ago |

|||||||

|

Nov. 11 |

Oct. 11 |

% Change |

Nov. 11 |

Nov. 10 |

% Change |

Sep. 11 to Nov. 11 |

Sep. 10 to Nov. 10 |

% Change |

|

|

For Sale |

1846 |

1854 |

-0.4% |

1846 |

2638 |

-30% |

1838 |

2707 |

-32.1% |

|

Sold |

205 |

189 |

8.5% |

205 |

207 |

-1% |

208 |

205 |

1.5% |

|

Pended |

292 |

278 |

5% |

292 |

235 |

24.3% |

266 |

262 |

1.5% |

At Luxury Living Fort Lauderdale, our specialty is helping clients buy, sell and rent homes in the Fort Lauderdale market. Whether you’re looking for a waterfront home, a beachfront condo or anything in-between, we can help!