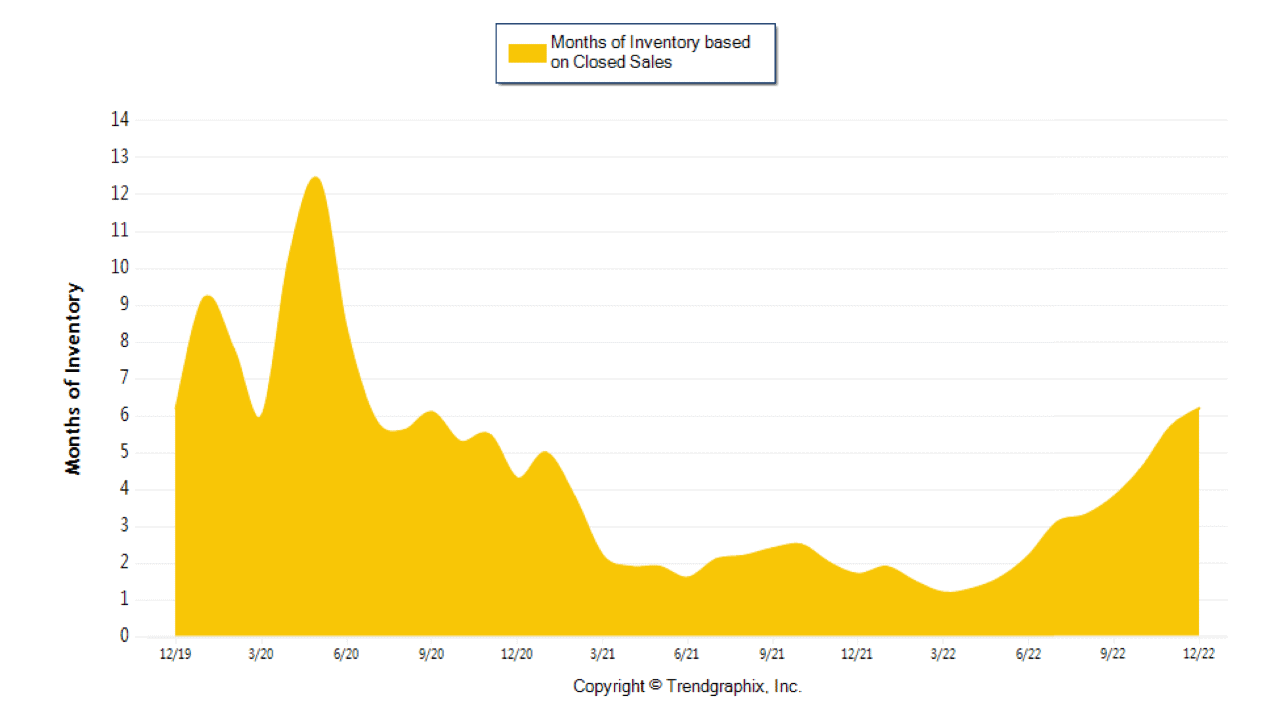

December 2022 Was A Buyer’s Market

A buyer’s market is when there are more than 6 months of inventory based on closed sales. A seller’s market is when there is less than 3 months of inventory based on closed sales. A neutral market is when there is 3 – 6 months of inventory based on closed sales.

Caveat: This report includes information for single-family homes, townhomes and condos. While the data from all three property types reflects we experienced a “buyer’s market” during September, sales are very different for each property type. For example, the single-family homes market was neutral. If you would like market data on a specific property type, please contact us!

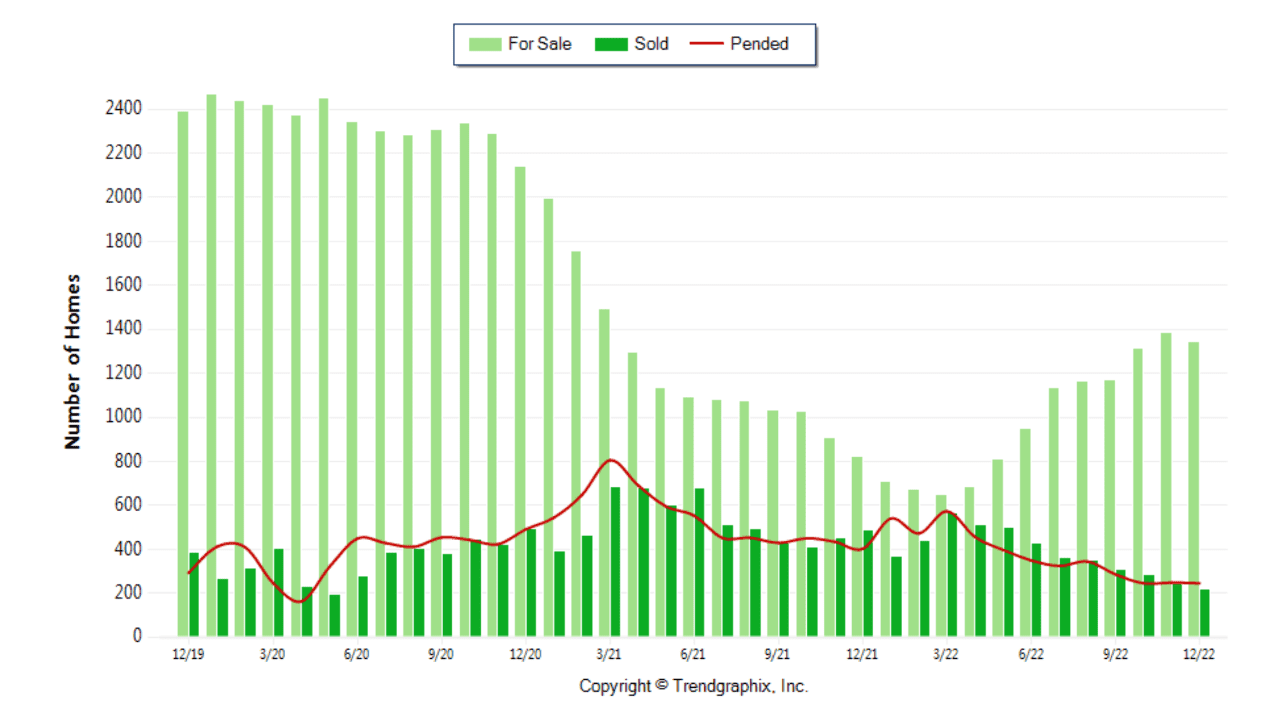

Home sales (Sold) were 217, down 55.6% from 489 in December of 2021 and 11.4% lower than the 245 sales in November 2022.

Current inventory (For Sale) of properties available this month is higher by 524 units or 63.8%. This year’s bigger inventory means that buyers who waited to buy may have a bigger selection to choose from. The number of current inventory is up 3% compared to November 2022.

Homes under contract (Pending Sale) was a decrease of 1.2% in the pended properties in December 2022, with 246 properties versus 249 December 2022. This month’s pended property sales were 39% lower than in December 2021.

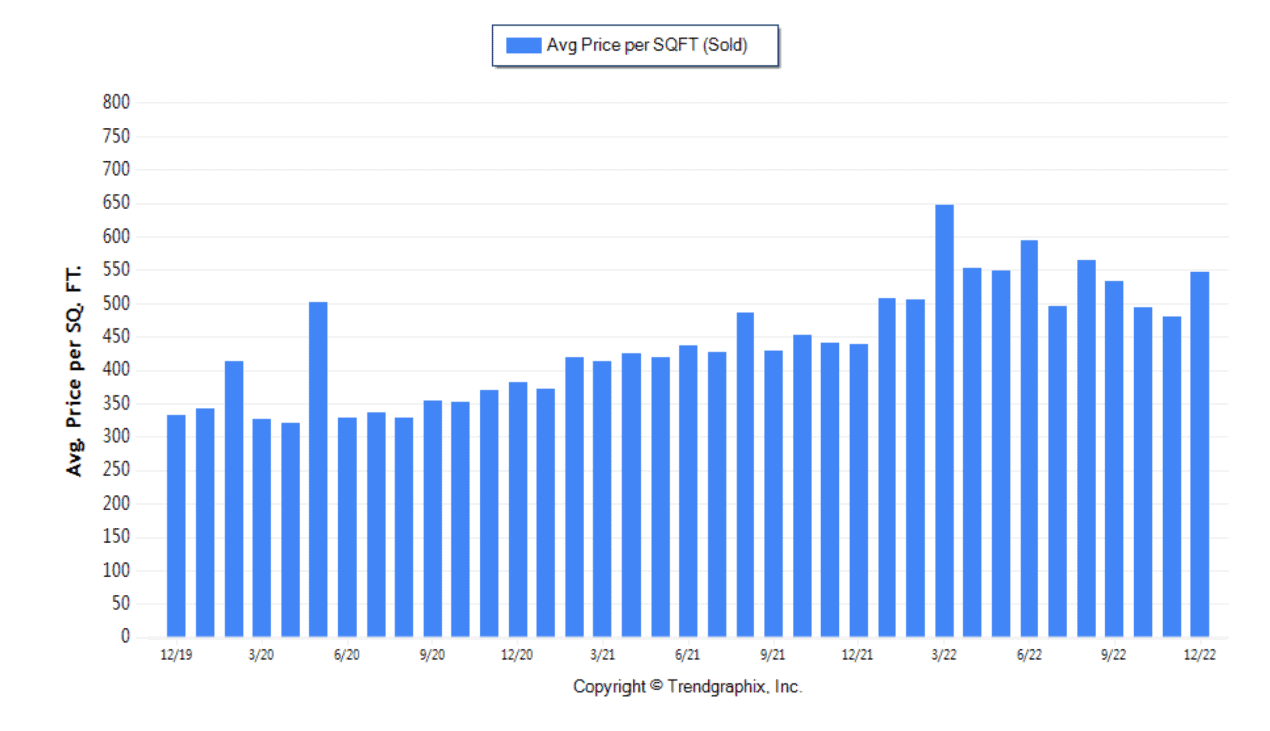

The Average Sold Price Per Square Foot Was Neutral*

The Average Sold Price per Square Footage is a great indicator for the direction of property values. Since Median Sold Price and Average Sold Price can be impacted by the “mix” of high or low end properties in the market, the Average Sold Price per Square Footage is a more normalized indicator on the direction of property values. The December 2022 Average Sold Price per Square Footage of $547 was up 14% from $480 in November 2022, and up 24.9% from $438 in December 2021.

* Based on 6 month trend – Appreciating/Depreciating/Neutral

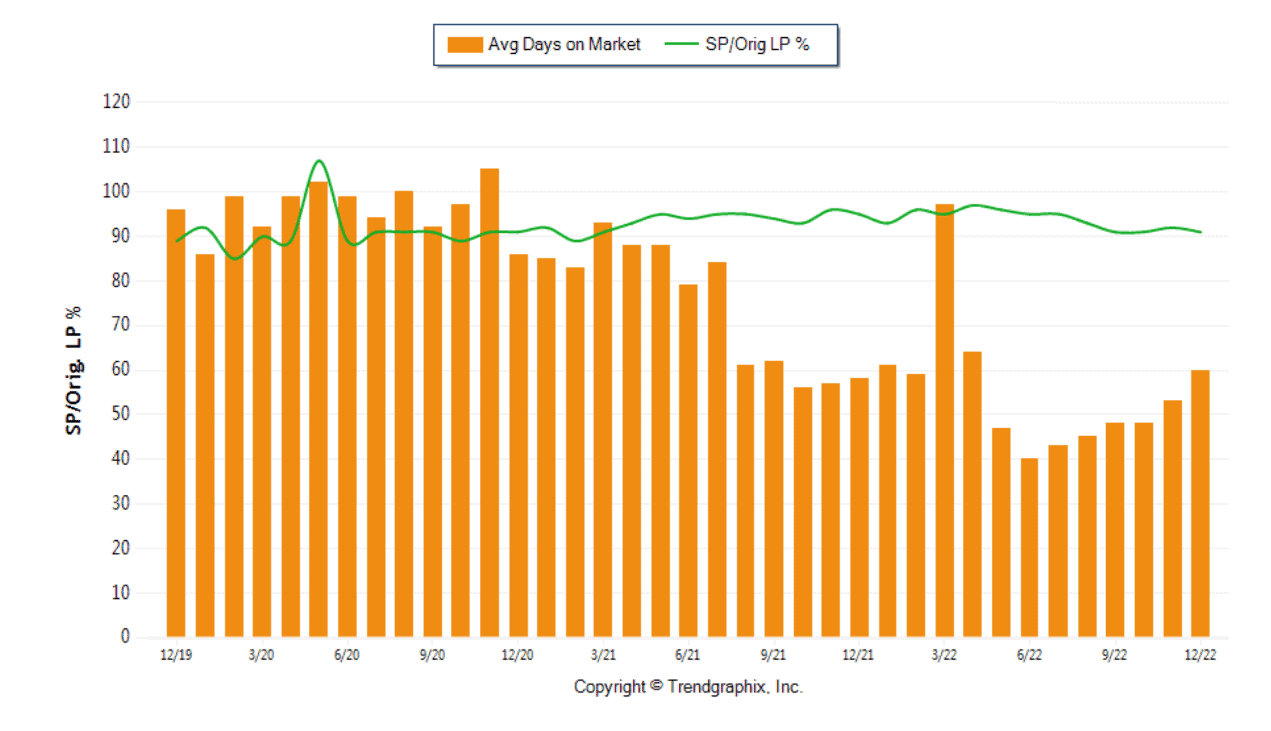

The Days On Market Shows An Upward Trend*

The average Days on Market (DOM) shows how many days the average property is on the market before it sells. An upward trend in DOM indicate a move towards more of a Buyer’s market, a downward trend indicates a move towards more of a Seller’s market. The DOM for December 2022 was 60, down 13.2% from 53 days in November 2022 and up 3.4% from 58 days in December 2021.

The Sold/Original List Price Ratio Remains Steady**

The Sold Price vs. Original List Price reveals the average amount that sellers are agreeing to come down from their original list price. The lower the ratio is below 100% the more of a Buyer’s market exists, a ratio at or above 100% indicates more of a Seller’s market. This month Sold Price vs. Original List Price of 91% was down 1.1% from November 2022 and down from 4.2% in December 2021.

* Based on 6 month trend – Upward/Downward/Neutral

** Based on 6 month trend – Rising/Falling/Remains Steady

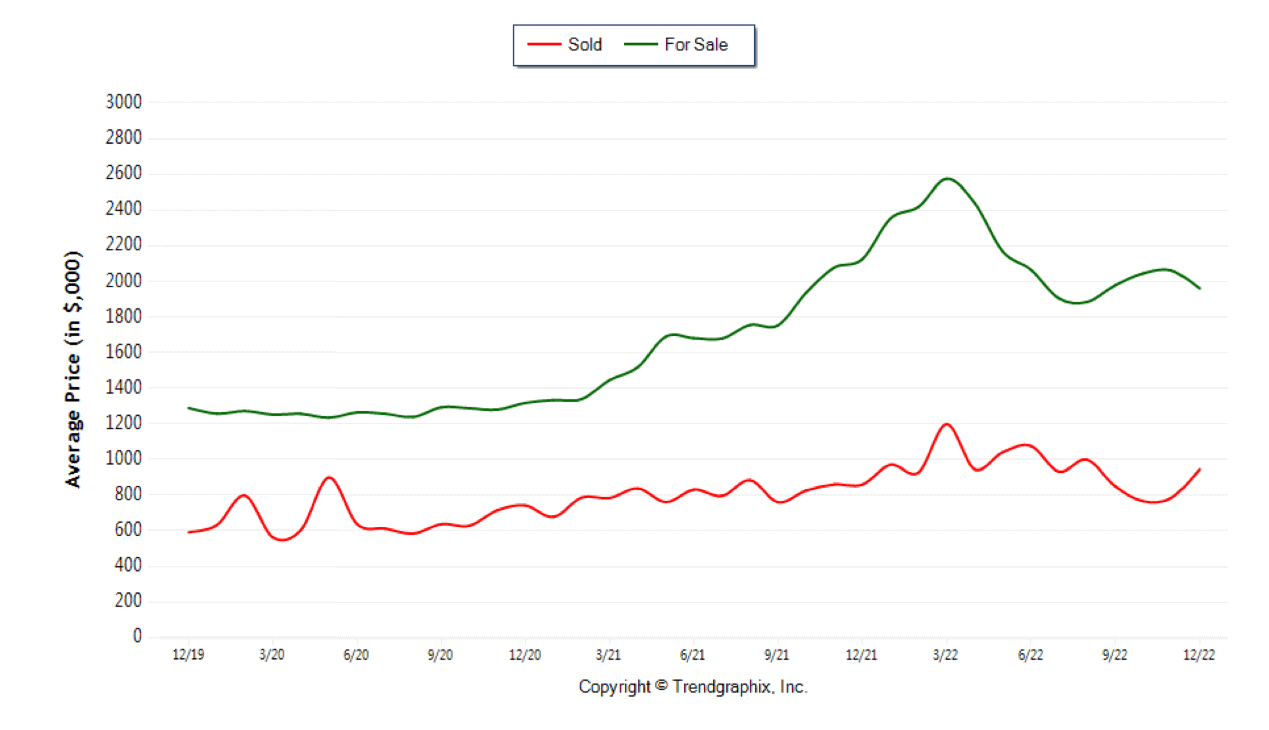

The Average For Sale Price was Neutral*

The Average For Sale Price in December 2022 was $1,962,000, up 7.7% from $2,125,000 in December 2021 and down 4.8%% from $2,062,000 in November 2022.

The Average Sold Price is Neutral*

The Average Sold Price in December 2022 was $949,000, up 9.9% from $861,000 in December 2021 and up 20.4% from $786,000 November 2022.

The Median Sold Price is Neutral*

The Median Sold Price in December 2022 was $482,000, down 2.6% from $495,000 in December 2021 and up 5.9% from $455,000 November 2022.

* Based on 6 month trend – Appreciating/Depreciating/Neutral

Months of Inventory based on Closed Sales

The December 2022 Months of Inventory based on Closed Sales of 6.2 was increased by 268% compared to December 2021 and up 8.8% compared to November 2022.

Months of Inventory based on Pended Sales

The December 2022 Months of Inventory based on Pended Sales of 5.5 was increased by 171.8% compared to December 2021 and down 1.8% compared to November 2022.