Since the 2008-2009 financial crisis, the U.S. economy has made steady progress. Unemployment is down from 10.1% on October of 2009 to 8.3%. Home sales, which are still low relative to normal conditions nationwide, have increased 32% since May 2010. In addition, improvements have been made in various areas from vehicle sales to construction spending.

In Florida, foreclosures are down by about a third from 2010 figures and the typical single family home is selling for 7.8% more than it did a year ago, according to Florida Realtors. In addition, median sales prices are the highest they’ve been since 2009. Here’s what John Tuccillo, chief economist for the Realtors group said recently:

“Home prices are up thanks to a rebound in employment and in the stock market. Investors, particularly from abroad, are once again realizing the Sunshine State is a good place to buy.”

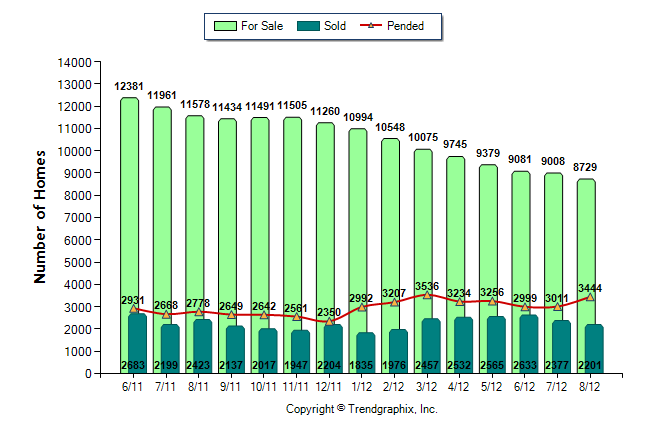

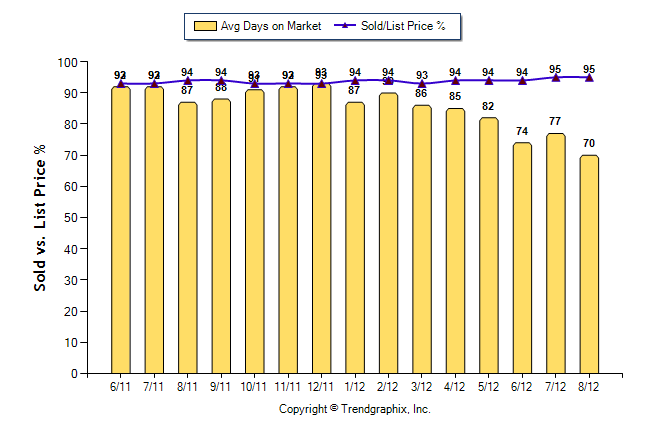

Following is a market snapshot of the Greater Fort Lauderdale / Broward County real estate market, comparing August 2011 with August 2012:

- The number of Greater Fort Lauderdale / Broward County homes listed for sale decreased 24.6% (11,578 vs. 8,729).

- The number of Greater Fort Lauderdale / Broward County homes sold decreased 9.2% (2,423 vs. 2,201).

- The average amount of days a Greater Fort Lauderdale / Broward County home was listed for sale decreased 19.5% (87 vs. 70).

- The final sales price of a Greater Fort Lauderdale / Broward County home increased from 94% to 95% of the original listed price.

Number of Homes in Greater Fort Lauderdale / Broward County For Sale vs. Sold vs. Pended (June 2011 – August 2012):

Average Days A Greater Fort Lauderdale / Broward County Home Was Listed For Sale & Sales Price vs. Original Listed Price (June 2011 – August 2012):