April 2024 Was A Buyer’s Market

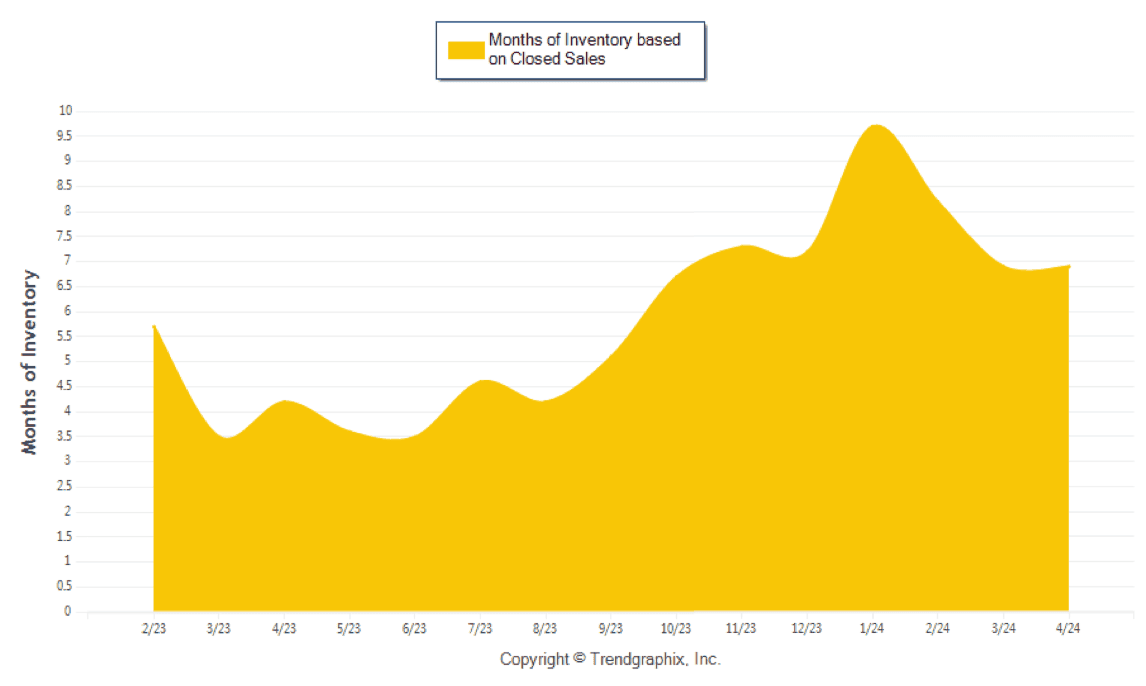

A buyer’s market is when there are more than 6 months of inventory based on closed sales. A seller’s market is when there is less than 3 months of inventory based on closed sales. A neutral market is when there is 3 – 6 months of inventory based on closed sales.

Caveat: This report includes information for single-family homes, townhomes and condos. While the data from all three property types reflects that we experienced a “buyer’s market” during April 2024, sales are very different for each property type. If you would like market data on a specific property type, please contact us!

April 2024 Was A Buyer’s Market**

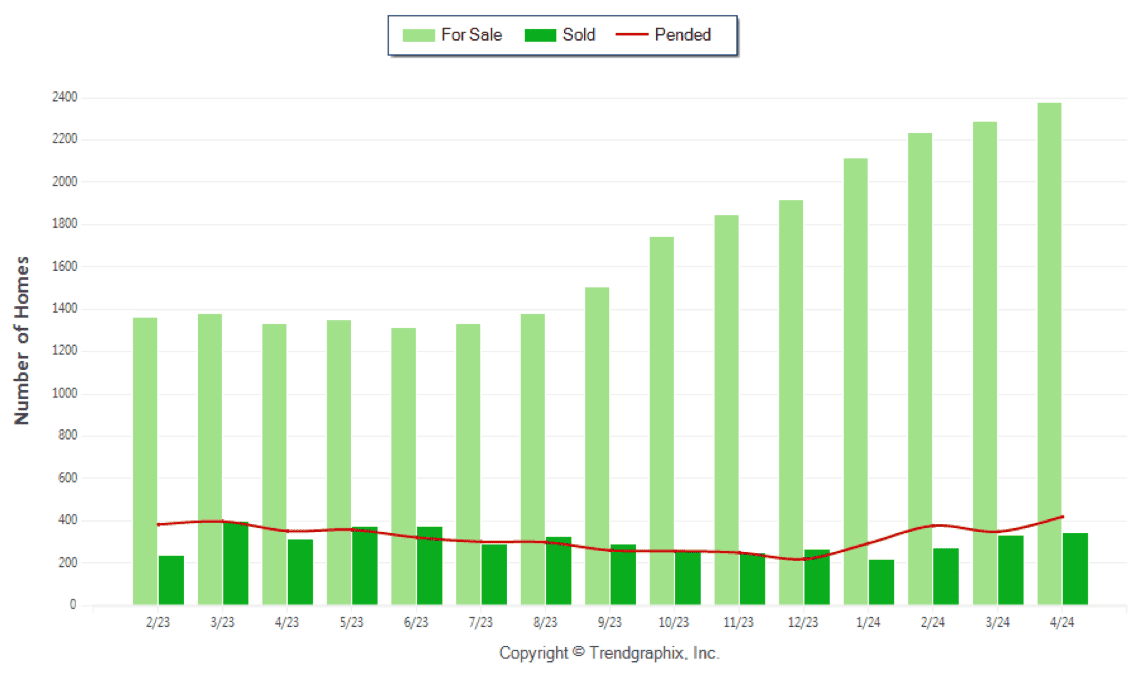

Home sales (Sold) for April 2024 was 343, which is up 8.9% compared to April 2023 and 3.6% higher compared to March 2024.

Current inventory (For Sale) of properties for April 2024 was 2,350 units, which is up 78.9% compared to April 2023 and up 4.1% compared to March 2024.

Homes under contract (Pending Sale) for April 2024 was 420, which is up 20% compared to March 2024 and up 19% compared to April 2023.

**Buyer’s market: more than 6 months of inventory based on closed sales. Seller’s market: less than 3 months of inventory based on closed sales. Neutral market: 3 – 6 months of inventory based on closed sales.

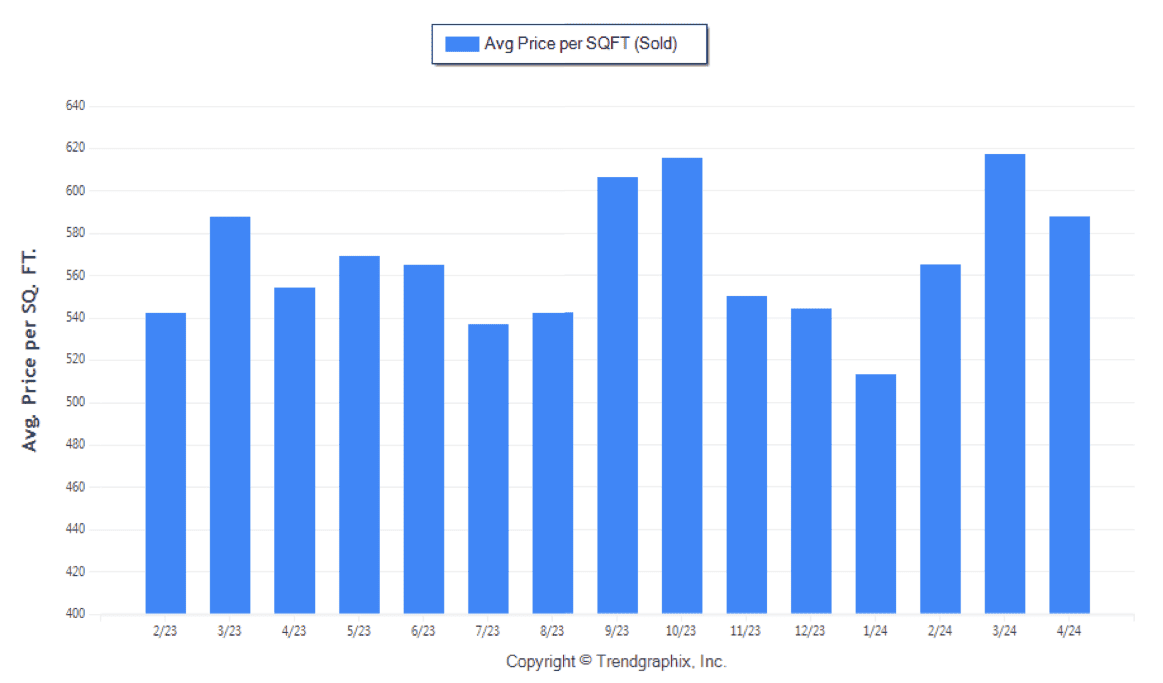

The Average Sold Price Per Square Foot Was Neutral*

Average Sold Price per Square Foot in March 2023 was $588. It was down 4.7% compared to March 2024 and up 6.1%

compared to April 2023.

The Average Sold Price per Square Footage is a great indicator for the direction of property values. Since Median Sold Price and Average Sold Price can be impacted by the “mix” of high or low end properties in the market, the Average Sold Price per Square Footage is a more normalized indicator on the direction of property values.

* Based on 6 month trend – Appreciating/Depreciating/Neutral

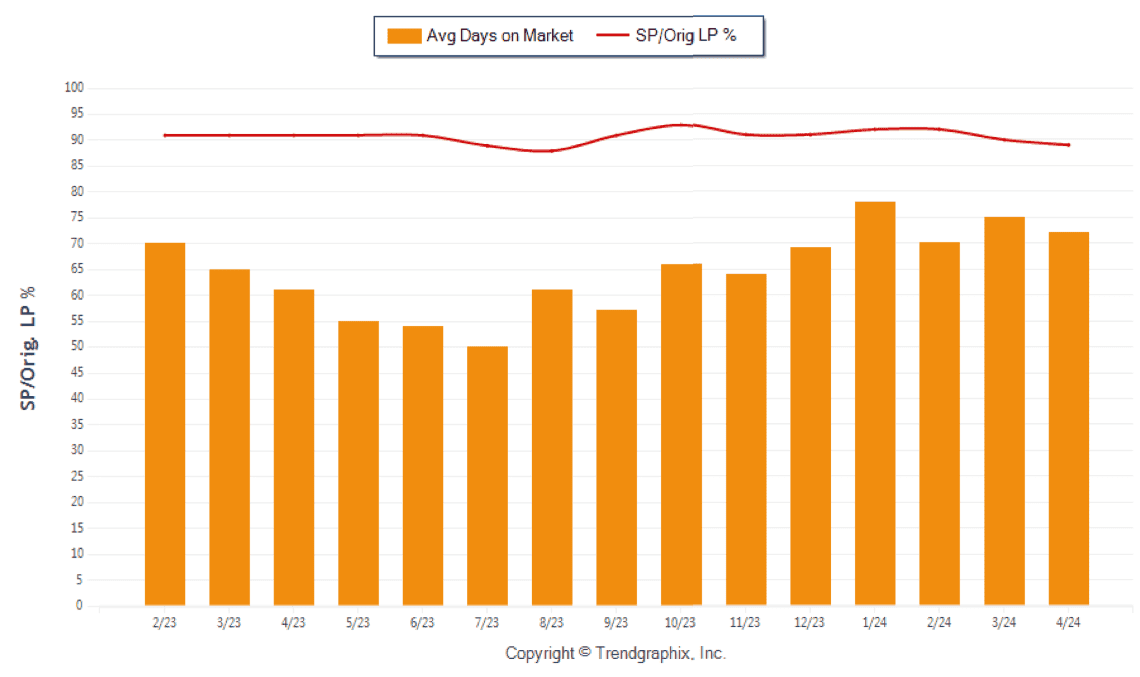

The Days On Market Trend Was Neutral*

Average Days on Market (DOM) in April 2024 was 72. It was down 4% compared to March 2024 and up 18% compared to April 2023.

The average Days on Market shows how many days the average property is on the market before it sells. An upward trend in DOM indicate a move towards more of a Buyer’s market, a downward trend indicates a move towards more of a Seller’s market.

* Based on 6 month trend – Upward/Downward/Neutral

The Sold/Original List Price Ratio Was Falling**

Sold/Original List Price in April 2024 was 89%. It was down 1.1% compared to March 2024 and down 2.2% compared to April 2023.

The Sold Price vs. Original List Price reveals the average amount that sellers are agreeing to come down from their original list price. The lower the ratio is below 100% the more of a Buyer’s market exists, a ratio at or above 100% indicates more of a Seller’s market.

** Based on 6 month trend – Rising/Falling/Remains Steady

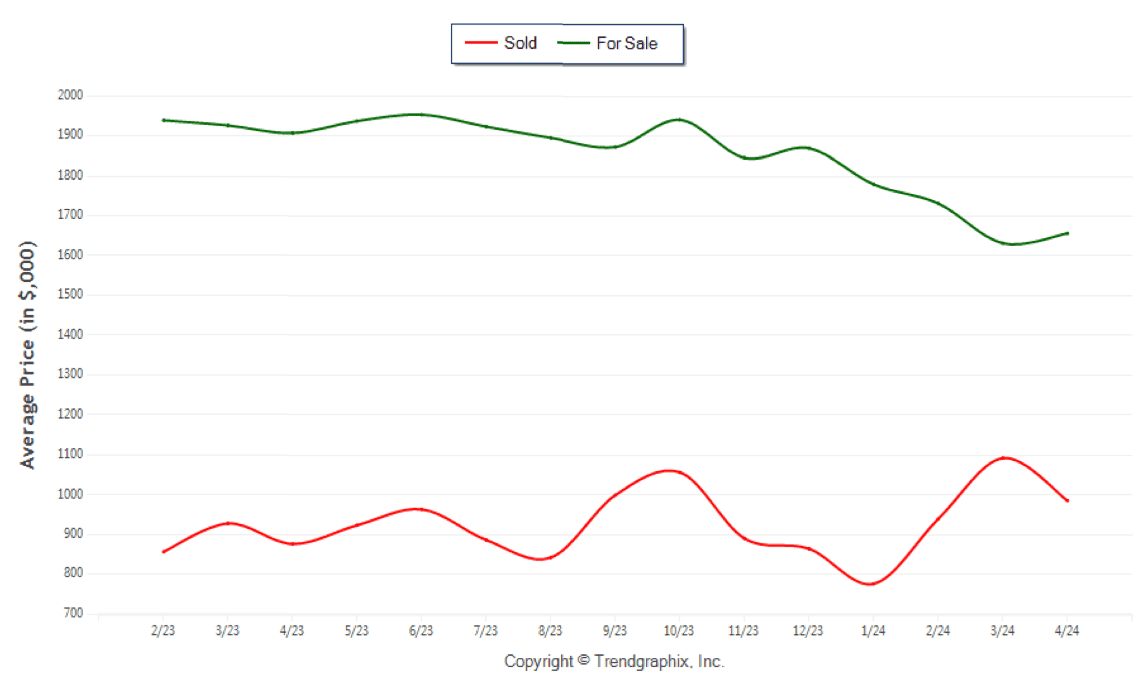

The Average For Sale Price Was Neutral*

The Average For Sale Price in April 2024 was $1,657,000. It was down 13.1% compared to April 2023 and up 1.5% compared to March 2024.

The Average Sold Price Was Neutral*

The Average Sold Price in April 2024 was $986,000. It was up 12.4% compared to April 2023 and down 9.8% compared to March 2024.

* Based on 6 month trend – Appreciating/Depreciating/Neutral

Months Of Inventory Indicate A Buyer’s Market

Months of Inventory based on Closed Sales in April 2024 was 6.9. It increased 63.9% compared to April 2023 and the same when compared to March 2024.

All reports are published April 2024, based on data available at the end of March 2024. This representation is based in whole or in part on data supplied by the Realtor Association of Miami, the Greater Fort Lauderdale Realtors, or the Southeast Florida Multiple Listing Service (MLS). Neither the Board or its MLS guarantees or is in any way responsible for its accuracy. Data maintained by the Board or its MLS may not reflect all real estate activity in the market.