Before you begin searching for your dream Fort Lauderdale luxury home, it’s important to know how much home you can afford. While you most likely have a solid idea of the mortgage payment you are comfortable paying every month, banks and other lending institutions will look at certain factors to determine what they think you can afford.

The formula used by home mortgage lenders is: your assets, your liabilities, your current ability to generate cash and your FICO score. If you have ever suspected there is some kind of mysterious secret formula involved in coming up with the last one, your suspicion was valid. But your FICO score isn’t a total mystery —some parts of their formula have been made public. Since the system is so pervasive, it’s good to know as much about it as you can.

To begin with “FICO” is the name of a company that was created in the 50s by Bill Fair and Earl Isaac. The two men got together and engineered a credit scoring system, and so Fair Isaac COmpany was created. Once Fannie Mae and Freddie Mac began using their services, it became a booming business.

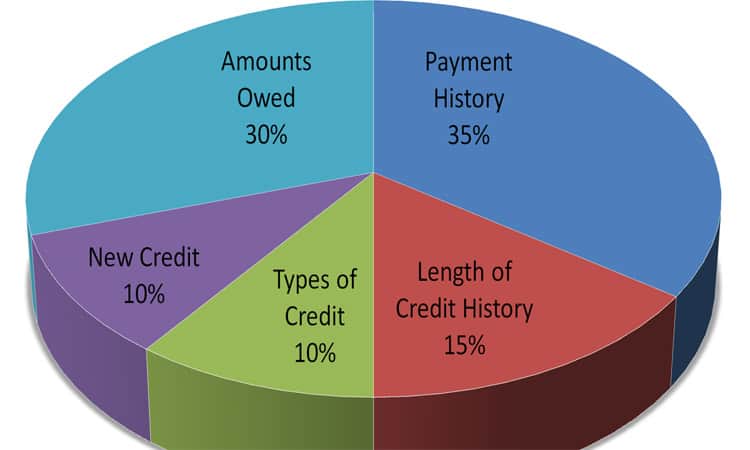

Today all the major consumer-reporting agencies (Equifax, Experian, TransUnion, PRBC and Innovis) use them. As to how they come up with their all-important scores, FICO has shared some information:

• 35% Payment history: Information like bankruptcies, liens, judgments, settlements, charge offs, repossessions, foreclosures, or late payments. It makes up more than a third of your score.

• 30% Amounts owed: Your current state of indebtedness.

• 15% Length of credit history: This one is why borrowing anything early on in your consuming career is a good idea. A long history makes you more trustworthy.

• 10% New credit: Opening lots of new credit accounts can hurt your credit score.

• 10% Types of credit used: A variety of the kind of borrowing you have done also makes you more trustworthy: revolving credit cards, car loans, home loans and lines of credit all broaden your appeal (at least the way FICO sees things).

While the FICO score formula might sound reassuringly simple, remember we said FICO shared “some information.” A credit analyst wrote candidly about the Types of credit used category: “It carries the same weight as the New credit category…but in reality, the two categories aren’t quite equal.” If you had been under the impression that 10% = 10%, you now know otherwise.

Also, FICO itself states that the percentages it makes public “are for the general population. For particular groups…the relative importance of these categories may be different.” In other words, the percentages are hard and fast, unless you are in a particular group. If you ask what is considered ‘a particular group,’ it gets mind-numbingly confusing. Sort of like the sound of FICO clearing its corporate throat and changing the subject.

SOURCE: https://www.cafecredit.com/credit-score-range/

Even though the FICO score formula has some gray areas, it’s good to know the basics. If you need help finding a really good mortgage loan officer, contact us! We know some of the best people in the business. Then, we can start shopping for your awesome Fort Lauderdale luxury home!