According to Freddie Mac, fixed rates on 30-year mortgages in the U.S. dropped to 3.87 percent — an all-time low — and the average 15-year rate dropped to 3.14 percent. This is encouraging news for new home buyers and current home owners, especially since President Obama introduced a plan yesterday aimed at helping borrowers benefit from the low rates. In the plan, homeowners would be able to refinance into loans guaranteed by the Federal Housing Administration, even if their home debt is more then their properties are worth.

A report from the Commerce Department last week showed U.S. gross domestic product—the value of all goods and services produced—grew at an annual rate of 2.8% in the October-to-December period. The data showed the U.S. economy expanded at the fastest pace since the second quarter of 2010, yet fell short of the expected 3% rate.

For the week ended Thursday, January 26, 2012, the 30-year fixed-rate mortgage averaged 3.87%, down from 3.98% the previous week and 4.81% a year ago. Rates on 15-year fixed-rate mortgages averaged 3.14%, down from 3.24% last week and 4.08% a year earlier.

Five-year Treasury-indexed hybrid adjustable-rate mortgages, or ARM, averaged 2.8%, below the 2.85% rate averaged last week and 3.69% a year ago. One-year Treasury-indexed ARM rates averaged 2.76%, down from 2.74% and 3.26%, respectively.

To obtain the rates, 30-year and 15-year fixed-rate mortgages required an average 0.8 percentage point payment. Five-year and one-year adjustable rate mortgages required an average 0.7 percentage point and 0.6 percentage point payment, respectively. A point is 1% of the mortgage amount, charged as prepaid interest.

via The Latest on Mortgage Rates: Still Low – Developments – WSJ.

Almost half of all single-family homes with a mortgage in Miami-Dade, Broward and Palm Beach counties are underwater — meaning the home is worth less than what is owed — according to fourth quarter 2011 data provided by Zillow.com, a real estate website. The historically low mortgage rates, coupled with the government’s relief plan may by the silver bullet homeowners have been hoping for.

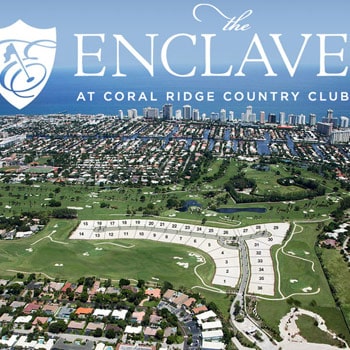

New home buyers, on the other hand, have a terrific opportunity to take advantage of home prices in Fort Lauderdale that are at their lowest since 2000, plus historically low mortgage rates — a win, win!