Home prices have dropped drastically since the peak of the housing boom and mortgage rates are at historic lows, so what is Buffett’s advice? Along with equities, single-family homes are a very attractive investment. If you are certain you will live in a home for the next 5 to 10 years, buying a house and financing it with a 30-year mortgage is a terrific deal. Also, if you are an investor that’s a handy type, consider buying a couple of homes at distressed prices, finance them with 30-year mortgages and find renters.

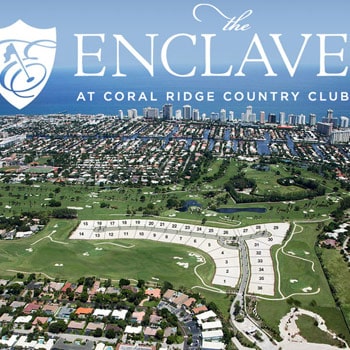

Buffett’s advice is in line with our recent blog posts, including Should You Buy a Home in 2012? Analysts are predicting an end to the house value decline in 2012. However, in certain key markets like Fort Lauderdale, home prices are already on the rise. As reported in the Fort Lauderdale Real Estate Snapshot for January 2012, the price of homes sold in Fort Lauderdale have increased 9% — when comparing January 2011 to January 2012. The Fort Lauderdale real estate market includes neighborhoods like Bay Colony, Coral Ridge, Las Olas Isles, Harbor Beach, Poinsettia Heights, Rio Vista, Victoria Park and Wilton Manors.

If you are interested in buying a home in Fort Lauderdale, but feel you may have missed the boat, don’t despair! There are still lots of homes for sale at great prices, including waterfront homes, oceanfront condos and luxury real estate.

Below is a clip of the interview. Fast forward to the 5:18 mark to watch the part of the interview where Buffett weighs in on a single-family home vs. stock investment.

If you are unable to watch the video, here’s the transcript, courtesy of CNBC:

BECKY: All right, let’s— we can talk more about this later.

But I also want to start off while we’re here— at this point the market, the Dow and the S&P, are sitting at just about the highest levels we’ve seen in four years. We have seen an incredible run over the last several months, and you are somebody who had stepped in four years ago— or I’m sorry, back in 2008 when you wrote that op-ed piece for The New York Times. The headline was `Buy American Stocks. I Am.’ We’ve come a long way in the market since then. The Dow at that point was below 9,000. And I want to know what you think about stocks at these prices. Do you still think that this is a great time to be buying stocks?

BUFFETT: Well, stocks are businesses and the question is you have to invest in something. If you get your money in your wallet, it’s invested. It’s just invested at zero. And, unfortunately, if you got your money in a bank these days, it’s invested at zero. Or if you have it in Treasury bills, it’s invested at zero. I’ve got a section in the report where I say that if held over a long period of time, there’s no question in my mind that equities generally, a diversified group of leading companies, is going to outperform, in my view, dramatically, paper money or nonproductive assets such as gold. That’s no forecast for the next three months or six months or a year, but it— I think it’s obvious that owning really first-rate productive businesses— and there’s hundreds of them— you just— you know, you get a compound over time. They either pay the money out to you, they reinvest it, they buy in shares so that your ownership interest goes up. So equities are still cheap relative to any other asset class.

BECKY: But they’re not…

BUFFETT: I would say the single-family homes are cheap now, too.

BECKY: You would?

BUFFETT: Yeah, single-family homes— but if I had a way of buying a couple hundred thousand single-family homes and had a way of managing— the management is enormous— is really the problem because they’re one by one. They’re not like apartment houses. So— but I would load up on them and I would— I would take mortgages out at very, very low rates. But if anybody is thinking about buying a home— five years ago they couldn’t buy them fast enough because they thought they were going to go up, and now they don’t buy them because they think they’re going to go down. And interest are far lower. It’s a way, in effect, to short the dollar because you can— you can take a 30-year mortgage and if it turns out your interest rate’s too high, next week you refinance lower. And if it turns out it’s too low, the other guy’s stuck with it for 30 years. So it’s a very attractive asset class now.

BECKY: If you are a young individual investor at home and you have your choice between buying your first home or investing in stocks, where would you tell someone is the better bet?

BUFFETT: Well, if I thought I was going to live— if I knew where I was going to want to live the next five or 10 years I would— I would buy a home and I’d finance it with a 30-year mortgage, and it’s a terrific deal. And if I— literally, if I was an investor that was a handy type, which I’m not, and I could buy a couple of them at distressed prices and find renters, I think that’s— and again take a 30-year mortgage, it’s a leveraged way of owning a very cheap asset now and I think that’s probably as an attractive an investment as you can make now.